Current Prices: Gold USD 1924.22/oz (AUD 2878.56) And Silver USD 23.05/oz (AUD 34.49)

Gold prices rose on Friday and were on track for their first weekly gain in four as the dollar and bond yields fell after weaker U.S. nonfarm payroll numbers cast doubts over the trajectory of interest rate hikes beyond July yet again. Spot gold rose by 0.7% and was trading near $US1,925 an ounce at the US Close. Bullion gained 0/2% last week. Elsewhere, spot silver also rose 1.5% to $23.08 an ounce.

US share markets slipped on Friday. At the close of trade, the Dow Jones index fell by 187 points or 0.6%. The S&P 500 index dipped by 0.3% and the Nasdaq index shed 18 points or 0.1%. For the week, the Dow Jones slid 2%, the S&P 500 fell by 1.2% and the Nasdaq dropped 0.9%.

US government bond yields were mixed on Friday. The US 10-year Treasury yield rose by 3 points to 4.07%. But the US 2-year Treasury yield fell by 6 points to 4.95%. For the week, the 10-year yield jumped by 25 points with the 2-year yield up by 7 points.

Currencies were stronger against the US dollar in European and US trade. The Aussie dollar lifted from US66.21 cents to US67.00 cents and was near US66.75 cents at the US close.

In US economic data, nonfarm payrolls (employment) rose by 209,000 in June (survey: +230,000). The unemployment rate eased from 3.7% in May to 3.6% in June (survey: 3.6%) with the participation rate steady at 62.6% (survey: 62.6%). Average hourly earnings rose by 0.4% in June to be up 4.4% on a year ago (survey: 4.2%, prior: 4.4%). U.S. interest rate futures saw an increased probability of another rate hike by the Federal Reserve in November, according to CME’s FedWatch. The Fed did not hike rates in June but is widely expected to resume increases at its July meeting. Dallas Fed President Lorie Logan said there was a case for a rate rise at the June policy meeting.

Australian gold prices were down by 0.24% ($6.86 per oz) to AUD $2877.37 at the US close.

Australian silver prices rose by 0.60% ($0.21 per oz) to AUD $34.50 at the US close.

Current Gold and Silver Ratio is 83.50

Current AUD/USD is 0.66853

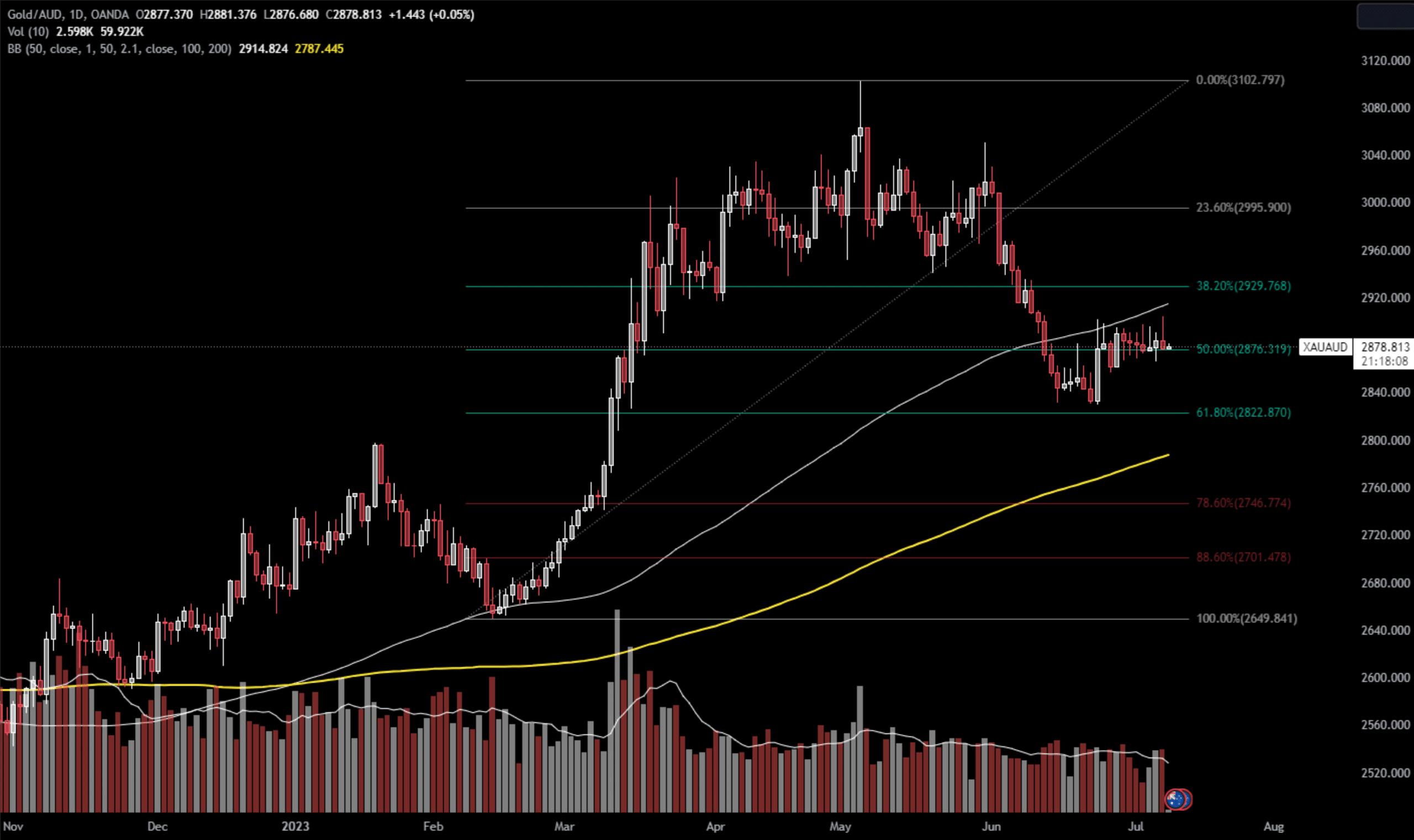

Gold Price in AUD Chart

Silver Price in AUD Chart

Silver Price in AUD Chart

To follow our market commentary and more, create a free trading account online HERE.

To follow our market commentary and more, create a free trading account online HERE.

Featured Product

Follow Us On Socials

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Silver Price in AUD Chart

Silver Price in AUD Chart To follow our market commentary and more, create a free trading account online

To follow our market commentary and more, create a free trading account online