Gold Price Continues to Baffle Investors

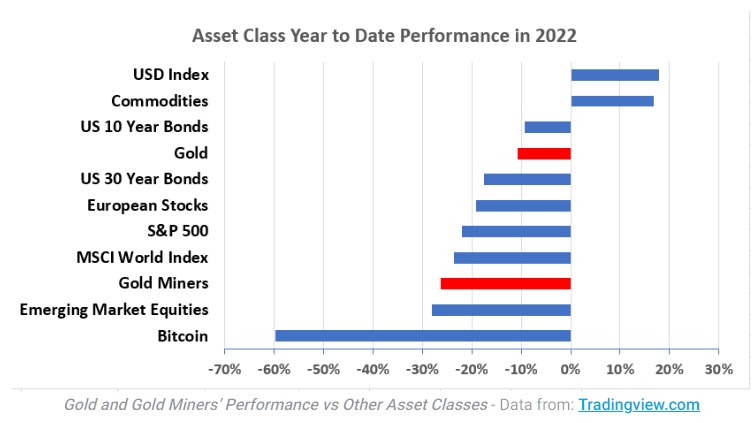

The gold price continues to baffle investors globally, as physical demand in a lot of regions seems quite robust, yet the price continues to struggle around the USD $1,650 mark, in a seemingly oblivious state as to what’s happening in the world. US inflation is out of control, the stock market is having a reasonably terrible time, and the war in Ukraine rages on. All of these factors combine to give an environment that would usually be quite positive for…

Gold & Silver Podcast – AUG 2022

Gold & Silver Podcast John Feeney of Guardian Gold caught up with Callum Newman of Fat Tail Investment Research last week to discuss the weak performance of gold and silver in recent months. It is no secret that inflation is gaining momentum, with central banks far from having things under control. In the podcast, John and Callum cover the recent moves behind gold and silver and overall investor sentiment. Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne,…

Fed deletes ‘transitory’ from the dictionary

The gold market seems poised and ready for a potential breakout, but we just need enough momentum to get through USD$1,850 in the next few weeks to confirm. US inflation remains a persistent problem for the Federal Reserve and the gold market is beginning to doubt the Fed’s ability to control it. The CPI numbers released on Wednesday this week saw US CPI remain elevated at a much higher level than the Fed’s target, coming in at 7% year on…

Welcome to 2022!

A warm welcome back from holidays from the team at Guardian Vaults to all of our valued clients! We have already seen some big moves in financial markets to start the new year, as the Federal Reserve turns as hawkish as ever. Tech stocks took a big hit overnight in the US with Cathie Woods Ark Invest ETF dropping -7% in a day. Interesting to see gold shrug off the latest FOMC minutes which talked of US Quantitative Easing ending…

GOLD STALLS AT $2,500

It been a perfect storm for the gold price in AUD the past few weeks, as gold managed to climb back to USD$1,800 whilst the AUD was under pressure from a collapsing iron ore spot price and announcements of extended lockdowns across Sydney and Melbourne. But is gold shaping up for a pullback? We’ll take a look this week at the price action in metals and the AUD/USD. Firstly, to gold in USD terms; we are looking neutral if anything,…

Bond Yields Plummet

BOND YIELDS PLUMMET Friday, 9 July 2021 BOND YIELDS PLUMMET A sharp plunge in Treasury yields hit markets this week. The US 10Y yield dropped to 1.29% which helped gold rise back above the USD$1,800 level. Markets are experiencing a greater than normal level of uncertainty as investors weigh up the possibilities of inflation, monetary tightening, and COVID mutations hindering the economic recovery. At least some market participants are clearly expecting weaker equity market performance from here on in,…

What is the Real Inflation Number?

Friday, 11 June 2021 This week saw the release of US CPI data for the month of May, and after April’s surprise CPI print of an annualized 4%, we saw inflation continue to trend higher in the US with the official numbers coming in above expectations yet again at 5% on an annualized basis, the highest since August 2008. Gold’s reaction was somewhat sluggish, rising 0.5% on the day, as the market seems unconvinced that the inflation genie has been let…

Jump in Inflation Spooks Markets

Friday, 14 May 2021 US inflation numbers surprised this week, with the year-on-year CPI number for April coming in at 4.2%, much higher than the anticipated 3.6%. Markets are currently not positioned well to experience an inflationary environment, so the US stock market sold-off -2% on the news. The bond market sold off too, pushing yields to 1.68% on 10Y notes and hence gold failed to react positively on the day, giving up some ground to trade back to USD$1,820….

Can gold and bond yields rise in unison?

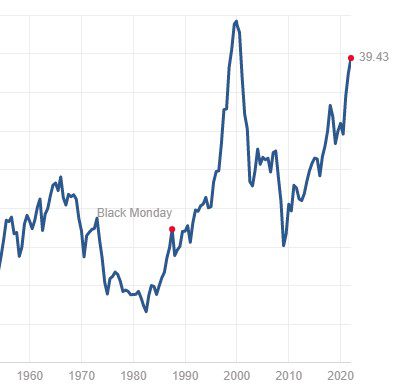

CAN GOLD AND BOND YIELDS RISE IN UNISON? Thursday, 25 March 2021 Anyone who follows gold on a regular basis would have noticed the current obsession with the US 10 Year bond yield, with each tick higher or lower corresponding with a very strong inverse correlation in the gold price. A lot of media commentary has been around the fact that this trend of rising bond yields could mean the death of gold, and that higher bond yields are seen…