Gold & Silver Price Update – ETF Flows Capitulate

Gold & Silver ETF Flows Report The precious metals complex continues to have lackluster performance of late, with markets clearly in a dumbed-down state of normalcy bias when it comes to both the geopolitical and economic landscape. Despite the war raging on in Ukraine, investors have now adapted to the ‘new normal’ as they become more focused on central bank rate hikes and seemingly unconcerned about the situation in Ukraine and Taiwan. Also absent from the majority of minds is…

Top 5 Reasons Why Investors Might Buy Silver Over Gold

Many precious metal investors have a preference of investing in silver over gold, under the assumption that they will see a better return in coming years. In this blog we outline the top 5 reasons why investors may choose to buy silver over gold. Silver and gold prices tend to have quite a strong correlation, but one metal can outperform the other in given years by quite some margin. Both metals tend to be influenced by US dollar strength or…

Welcome to 2022!

A warm welcome back from holidays from the team at Guardian Vaults to all of our valued clients! We have already seen some big moves in financial markets to start the new year, as the Federal Reserve turns as hawkish as ever. Tech stocks took a big hit overnight in the US with Cathie Woods Ark Invest ETF dropping -7% in a day. Interesting to see gold shrug off the latest FOMC minutes which talked of US Quantitative Easing ending…

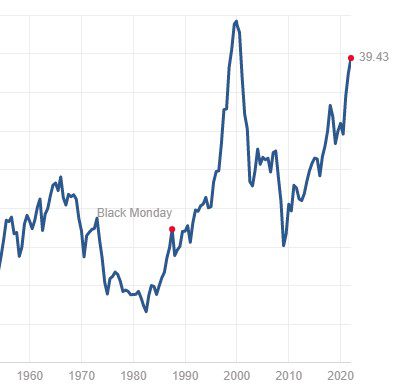

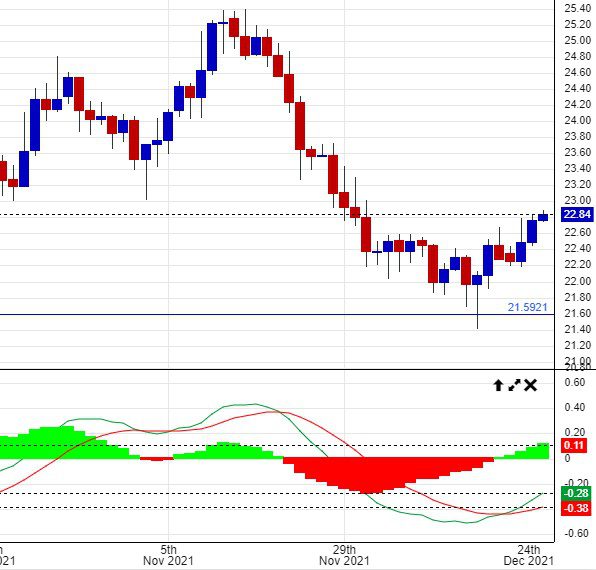

Silver Price Signals a Swing Higher

The silver price has upset a few bulls of late, after retreating from a high of USD $25.00 per ounce in November down to a wash-out low of $21.40. But there are some positive indications from the recent price action, hinting that a significant low has now been formed. From a technical perspective, it was very important for the price to hold this key $21.40 level as it coincides with the recent lows all the way back to the major…

Why the Federal Reserve Will Fail

News this week is dominated by what is being referred to as ‘China’s Lehman Brothers moment’. Property developer Evergrande shares are plummeting as there is no word from Beijing about a bail out package as yet. Finally, we are seeing this volatility spill over into other markets with the ASX down by 2% on Monday and iron ore futures getting crushed. Gold and silver have been caught up in the chaos with a flight to safety heading towards the US…

Silver Price & Demand Outlook

Last Friday saw the first big miss in US employment figures for quite a while. Expectations were for 720,000 jobs to be added in the non-farm payrolls data for the month of August, but the number fell well and truly short at only 235,000. The US dollar dropped, gold caught a bid, but silver was the stand out, jumping over 3% to $AUD 33.30 per ounce. We’ll take a good look at the silver price in this week’s update and…

Metals Crash During Monday Open

A very volatile start to week as both gold and silver were smashed into the open on Monday morning. Silver dropped almost $2 USD an ounce and gold more than $50 USD an ounce in what was called a ‘flash crash’ during a time where market liquidity was significantly lacking. So why the dramatic move in precious metal prices? And what does it mean moving forward? We will answer these questions in this week’s update as we delve into the…

Can I buy gold and silver bullion at the spot price?

Unfortunately, the average investor cannot buy bullion at the spot price, as all bullion products have a cost basis above spot that must be covered before any margin can be made by that refinery or mint. To explain further, let’s cover an explanation of what the ‘spot price’ is: The “spot price” refers to the price in which a commodity or precious metal is trading for immediate delivery in a given market, which differs to a ‘futures’ price which has…

Lockdowns to crush Australia’s GDP

Monday, 2 August 2021 As lock downs continue across Sydney and other parts of the country, there is a significant economic cost which will no-doubt influence both government and central bank policy decisions, and should impact asset prices moving forward. Domestic gold investors have seen local prices buoyed by the falling AUD/USD which has retreated from 77c in June to 73.50c at time of writing, with a chance the AUD continues to lose ground if the lockdowns last longer than…

A Positive Signal for Gold

A Positive Signal For Gold This week saw the much-anticipated US CPI data for the month of June, and the not-so-transitory inflation number surprised to the upside yet again. What is interesting to note; last month the higher-than-expected CPI led to gold selling off on heightened fears of Federal Reserve tapering, however this time the higher number saw gold catch a bid, moving up through $1,825 USD. In this week’s update we will explain why and comment on what could…