Buying Bullion Bars VS Coins – Top Pros and Cons

When it comes to investing in physical precious metals, such as gold and silver, investors often face the decision of whether to acquire bullion bars or coins. Both options offer unique advantages and considerations. In this article, we will explore the differences between physical bullion bars and coins, examining their characteristics, benefits, and potential drawbacks. There are several types of physical Bullion available for retail investors to purchase. Cast Bars: are made by pouring molten into a mould and then…

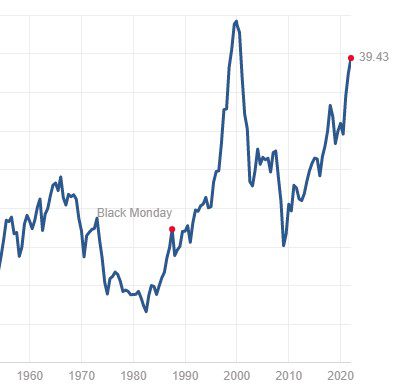

Can gold outpace inflation?

With inflation the top talking point of financial markets in 2023, the question on a lot of investors minds right now is: how do I invest in something which outperforms inflation? Right now, finding something that is a safe bet to outperform inflation rates of up to circa 7% is not easy. Central banks only weapon with combatting inflation is raising interest rates. We all know that higher interest rates are typically bad for pretty much every investment one can…

Gold & Silver Outlook 2023 – Guardian Gold

2022 Performance Our gold and silver outlook 2023 report will take a look back at the year that was and look forward to some of the key fundamentals for next year’s precious metals market. When comparing financial market performance in 2022, gold and silver did relatively well, although many investors would have been hoping for better returns, given the level of uncertainty and geopolitical crisis during the year. At the time of writing (December 13th) gold in AUD terms…

The Gold Investor Series 2022

With both gold and silver yet to react to the runaway inflation we are seeing globally, many investors may have questions about the market’s recent performance and what to expect moving forward. Fat Tail Investment Research is presenting a free online series this week with some of the biggest names in the gold investment community, including Peter Schiff and Jim Rickards. Given it is free to attend and has a cracking line up of speakers we thought we would share the…

How to Sell Gold or Silver Bullion in Sydney or Melbourne

4 easy steps to sell gold and silver bullion in Sydney or Melbourne If you are looking for a secure and convenient environment to sell bullion in Sydney or Melbourne CBD, Guardian Vaults is the best option for peice of mind. Investors can sell their gold and silver bullion anytime with the following four easy steps: Bring the bullion into Guardian Vaults offices for inspection. Get a live quote based on market rates, updating every 3 minutes. The price is…

Welcome to 2022!

A warm welcome back from holidays from the team at Guardian Vaults to all of our valued clients! We have already seen some big moves in financial markets to start the new year, as the Federal Reserve turns as hawkish as ever. Tech stocks took a big hit overnight in the US with Cathie Woods Ark Invest ETF dropping -7% in a day. Interesting to see gold shrug off the latest FOMC minutes which talked of US Quantitative Easing ending…

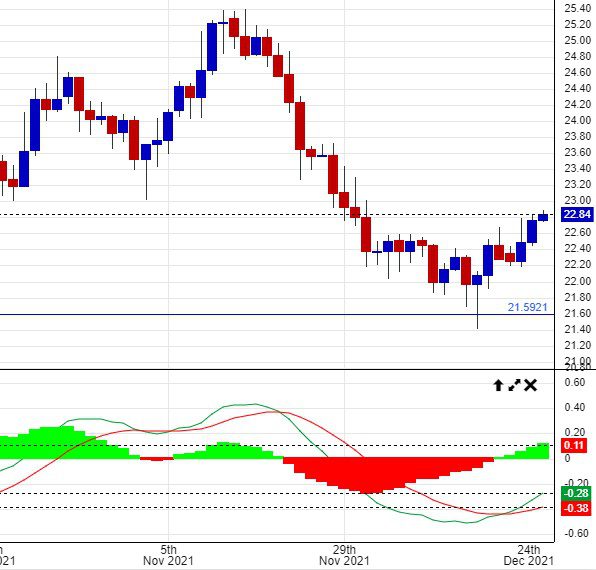

Silver Price Signals a Swing Higher

The silver price has upset a few bulls of late, after retreating from a high of USD $25.00 per ounce in November down to a wash-out low of $21.40. But there are some positive indications from the recent price action, hinting that a significant low has now been formed. From a technical perspective, it was very important for the price to hold this key $21.40 level as it coincides with the recent lows all the way back to the major…

Why the Federal Reserve Will Fail

News this week is dominated by what is being referred to as ‘China’s Lehman Brothers moment’. Property developer Evergrande shares are plummeting as there is no word from Beijing about a bail out package as yet. Finally, we are seeing this volatility spill over into other markets with the ASX down by 2% on Monday and iron ore futures getting crushed. Gold and silver have been caught up in the chaos with a flight to safety heading towards the US…

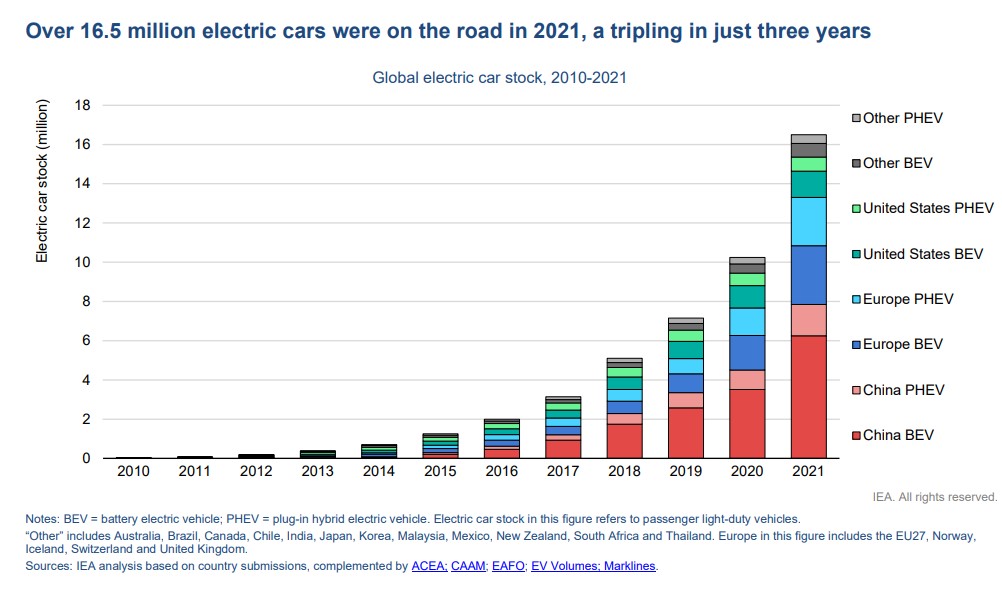

Silver Price & Demand Outlook

Last Friday saw the first big miss in US employment figures for quite a while. Expectations were for 720,000 jobs to be added in the non-farm payrolls data for the month of August, but the number fell well and truly short at only 235,000. The US dollar dropped, gold caught a bid, but silver was the stand out, jumping over 3% to $AUD 33.30 per ounce. We’ll take a good look at the silver price in this week’s update and…

Perth Mint Update – August 2021 Report

For this week’s update we will let the Perth Mint take the floor with a great summary of a very volatile month for precious metals. Manager of Investment Research at The Perth Mint, Jordan Eliseo covers whether or not gold is still an inflation hedge with some comments from billionaire John Paulson on why he’s bullish on gold prices moving forward. August 2021 also marked the 50-year anniversary for one of the most important events in gold’s recent history: when…