When it comes to investing in physical precious metals, such as gold and silver, investors often face the decision of whether to acquire bullion bars or coins. Both options offer unique advantages and considerations. In this article, we will explore the differences between physical bullion bars and coins, examining their characteristics, benefits, and potential drawbacks.

There are several types of physical Bullion available for retail investors to purchase.

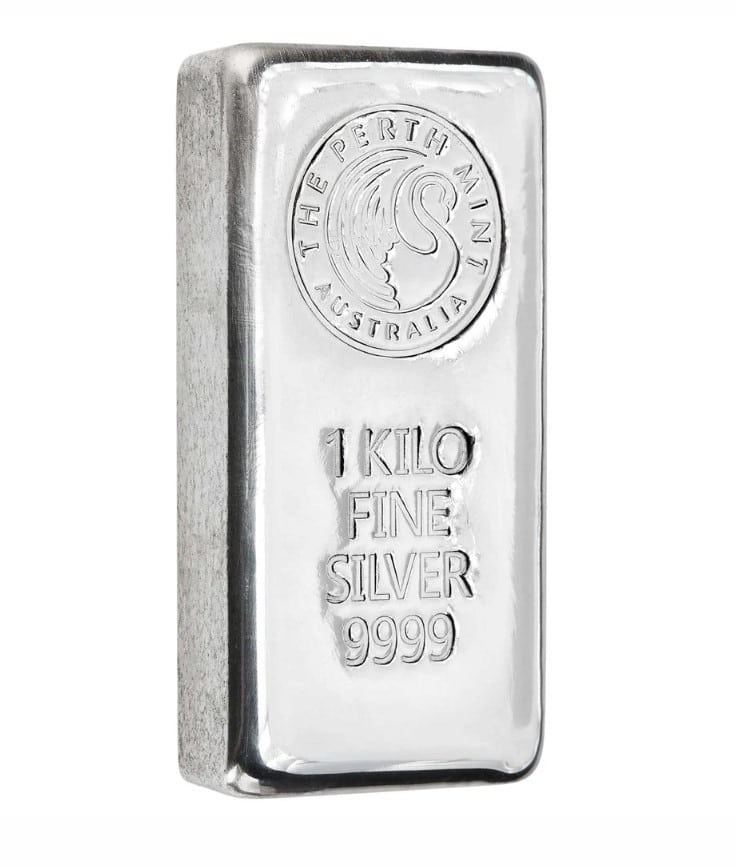

- Cast Bars: are made by pouring molten into a mould and then allowing it to cool and solidify. Cast bars often have a rougher, less polished appearance and can be more affordable than other types of bars.

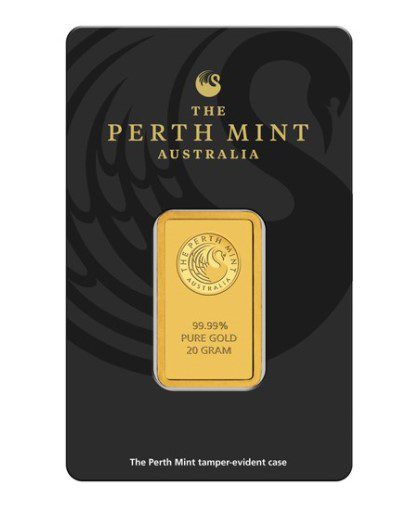

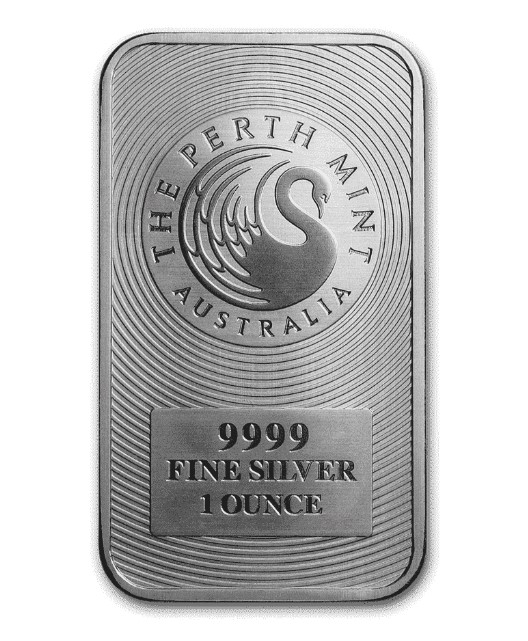

- Minted bars: are made by stamping or striking silver blanks with the weight and purity information. Minted bars often have a polished, more refined appearance and can be more expensive than cast bars.

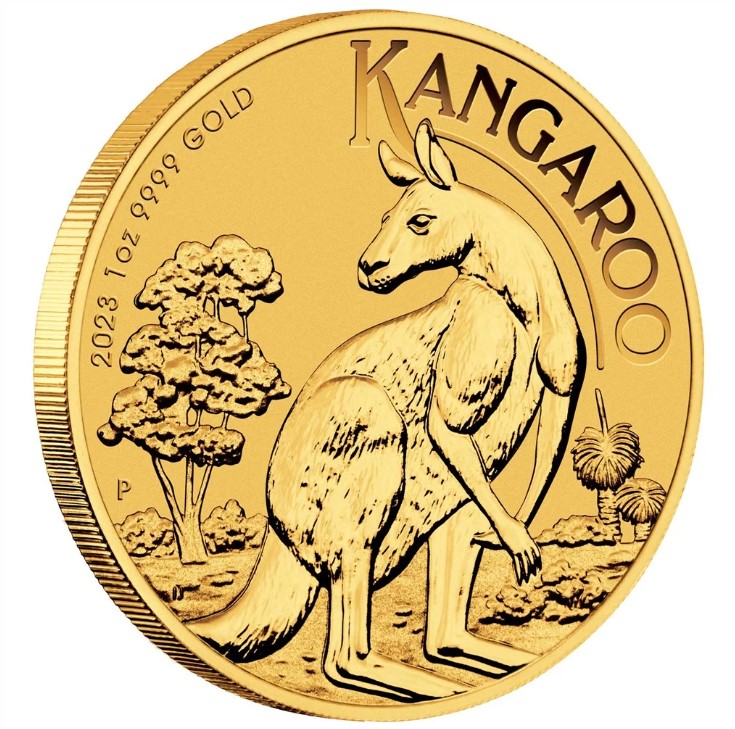

- Bullion Coins: are typically designed by an artist or designer who creates a digital or physical model of the coin and is made using a process called striking or minting, similar to the Minted Bar’s process.

Advantages and disadvantage between different options

Gold bullion bars, whether cast or minted and gold bullion coins all have their own unique advantages and disadvantages.

Gold Bullion Cast Bars

Pros:

- Generally have lower premiums over the spot price of gold compared to minted bars or coins

- Available in larger sizes, making them a more cost-effective way to invest larger amounts

- Uniform in shape and size, making them easy to stack and store and sell

Cons:

- Can be less aesthetically appealing than minted bars or coins.

- Might not have the same flexibility when the time comes to sell due to larger weights.

Gold Bullion Minted Bars

Pros:

Pros:

- Often come with an assay certificate, which guarantees the weight and purity of the gold.

- May have unique designs or finishes, making them more aesthetically appealing.

- More easily recognisable and tradable.

Cons:

- Higher premiums over the spot price of gold compared to cast bars.

- May not be available in as large of sizes as cast bars.

Gold Bullion Coins

Pros:

Pros:

- Often produced by government mints, making them easily recognisable and tradable.

- Can have unique designs or historical significance, making them collectible in addition to being an investment.

- Available in smaller denominations, making them more accessible to a wider range of investors.

Cons:

- Generally, have higher premiums over the spot price of gold compared to bullion bars

- Can be more susceptible to damage or wear compared to bars due to their design and material

Silver is typically much cheaper than gold, with a lower price per ounce. This can make it a more accessible investment option for some investors who may not have the funds to invest in gold. Silver bullion cast bars, minted bars, and coins all have their own unique advantages and disadvantages, as well as differences in premiums.

Silver Bullion Cast Bars

Pros:

Pros:

- Generally the most cost-effective option due to lower manufacturing costs.

- Typically come in larger weights, making them a good option for investors looking to buy in bulk.

- Easy to store due to their uniform shape and size.

Cons:

- May have a less refined appearance compared to minted bars and coins.

- May have slightly lower liquidity compared to minted bars and coins if you were trading P2P.

Silver Minted Bars

Pros:

Pros:

- Generally, have a more refined appearance compared to cast bars.

- It may come in a wider variety of weights and designs.

- Generally have higher liquidity compared to cast bars.

Cons:

- Silver-minted bars usually have higher premiums than cast bars due to their higher manufacturing costs.

Silver Bullion Coins

Pros:

Pros:

- Typically have the highest liquidity due to their global recognition and acceptance.

- May have collectible value in addition to their bullion value.

- Often come in smaller weights, making them more accessible to smaller investors.

Cons:

- Silver bullion coins usually have the highest premiums among the three options due to their higher manufacturing costs and potential collectible value. More ideal to buy per tubes or even a monster box to seek for some volume discounts.

Overall, the choice between investing in gold bullion cast bars, minted bars, or coins will depend on an individual’s investment goals, risk tolerance, and personal preferences. A good mix to diversify in a different size is often considered by our clients.

Gold Bullion Bars vs Coins

Gold bullion bars are usually rectangular blocks of pure gold, usually ranging in size from one gram to one kilogram. They are produced by private mints and government mints (such as The Perth Mint), and their value is based purely on the weight and purity of the gold they contain.

Gold bullion coins, on the other hand, are coins that are usually minted by government mints and have a face value, which is usually much lower than the value of the gold contained in the coin. The value of the coin is based on its gold content, as well as its rarity, condition, and historical significance.

One of the main advantages of investing in gold bullion bars is their lower premium. Since they are produced by private mints, there are fewer production costs associated with their manufacture, which means that they are often sold at a lower premium over the spot price of gold than gold bullion coins. This makes them a cost-effective way to invest in gold.

Another advantage of gold bullion bars is that they are easy to store and transport. Since they are compact and uniform in shape, they can be stacked neatly in a safe or storage facility, which makes them ideal for investors who want to store large quantities of gold in a small space. For example, the safe deposit box options at Guardian Vaults will fit a greater weight of bullion bars VS coins, as the coins packaging tend to take up more space.

Gold bullion coins, on the other hand, are often preferred by investors who are interested in collecting as well as investing. Since they are minted by governments, they often have a unique design and historical significance, which can make them more valuable to collectors.

In addition, gold bullion coins can be easier to sell in certain markets, since they are more widely recognized and accepted as a form of currency. This can make them a more liquid investment, which is important for investors who may need to sell their gold quickly in the event of a financial emergency.

Silver Bullion Bars vs Coins

Like gold, silver bullion can also come in the form of bars or coins. Silver bars are typically made using the same process as gold bars, and they can range in size from as small as one ounce to as large as 1,000 ounces. Silver coins, on the other hand, are typically smaller than bars and are often made in denominations of one ounce as the most popular size.

One of the advantages of silver bars is that they are generally cheaper than coins. This is because the manufacturing process for silver bars is simpler than for coins, which means that the production costs are lower. This can make silver bars an attractive option for investors who are looking for a cost-effective way to invest in silver.

However, like gold bars, one of the downsides of silver bars is that they can be difficult to sell privately. This means that investors may need to find a bullion dealer like Guardian Gold who is willing to buy the bars in larger volumes.

Silver coins, on the other hand, are generally easier to sell and very liquid given their low value per coin. They are recognized by dealers around the world, and there is a well-established market for silver coins. This means that investors can sell their coins quickly and easily, which can be an important consideration for those who may need to liquidate their investment quickly. Many silver coins are traded in the secondary market.

Another advantage of silver coins is that they can be much more collectible than silver bars. This means the selling value of the coin in the future could be well above the underlying spot value of the coin, depending on it’s rarity. Many Perth Mint silver coins like the lunar series are considered collectable and often have larger premiums in the secondary market some years after their initial release.

One of the most important considerations would be where you intend on liquidating your bars or coins in the future. The vast majority of bullion dealers will pay the same per ounce price on bars and coins, so it may be best to stick to bars if you intend on selling back to the bullion dealer you initially purchase through.

Gold & Silver Bullion Live Prices

To see our live prices on both gold and silver bullion coins and bars, simply click the image below.

Pros:

Pros: Pros:

Pros: Pros:

Pros: Pros:

Pros: Pros:

Pros: