Many precious metal investors have a preference of investing in silver over gold, under the assumption that they will see a better return in coming years. In this blog we outline the top 5 reasons why investors may choose to buy silver over gold.

Silver and gold prices tend to have quite a strong correlation, but one metal can outperform the other in given years by quite some margin. Both metals tend to be influenced by US dollar strength or weakness, as well as geopolitical uncertainty, interest rates and inflation fears. Silver is seen as less of a monetary asset and more like a commodity due to its vast industrial applications, so there are some key differences between the two precious metals.

Silver is a fascinating metal with unique properties that all investors should be aware of. Silver takes the number one position in both thermal conductivity and electrical conductivity of any element on the planet; which is why it is such an important metal when it comes to the electrical efficiency of solar power and electric vehicles.

Here are our top 5 reasons why investors might buy silver over gold

1. The Historic Gold/Silver Ratio

One major reason why silver bulls prefer silver over gold comes down to the historical ratio between the two metals known as the Gold:Silver Ratio. The ratio refers to how many ounces of silver it takes to buy an ounce of gold and is calculated by dividing the gold spot price by the silver price at any point in time.

When viewed with a historical context, the ratio provides us with an understanding of where the market currently values gold over silver, which metal is most popular as an investment at the time, and which may be seen as either overvalued or undervalued. As a quick summary, the higher the ratio the more ounces of silver it takes to buy an ounce of gold, or the lower the silver price, relative to gold.

We can see in the chart below that the ratio is quite volatile over a 30-year period, but the average is close to 60:1. So it might be fair to say that when the ratio is above 60:1 that silver seems the better buy from a historical perspective. We can see when the ratio spiked it 2020 to over 120:1 that was indeed one of the best times to sell gold and buy silver, as silver outperformed gold over the next 12 months by a hefty margin.

At today’s time of writing (13.05.2022) the ratio is currently at 87:1, which is a higher ratio than the mean of the past 30 years, indicating silver as the better buy right now. Should the ratio get below 50:1 that may be a good time to be selling silver to buy gold as gold tends to outperform after such levels are reached.

2. Increased volatility

2. Increased volatility

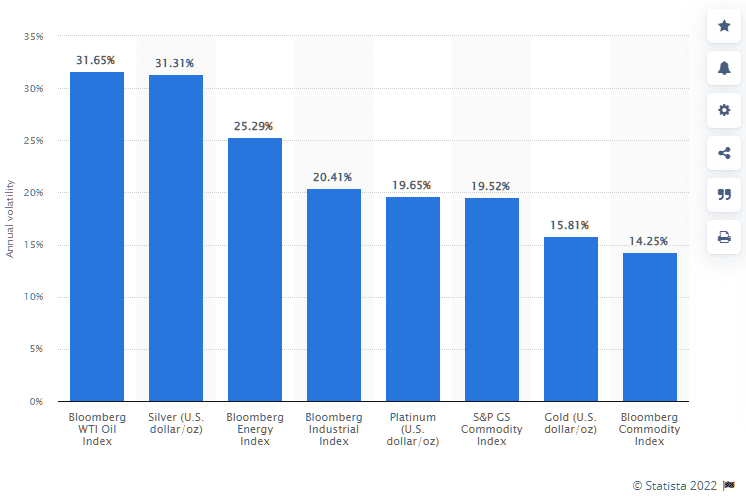

Volatility is not for everyone; however, it can work in your favor at times. Those investors who are looking for something that moves a little quicker than gold will often look at silver, as it can present opportunities for outperformance.

Given the silver market is much smaller than gold, it is naturally more volatile and tends to move in a much larger range than gold. This is the reason that younger investors who can handle volatility might prefer silver over gold, as it has the potential to outperform during a precious metals bull market.

Take the calendar year 2020 for example. During the year both metals performed well under an environment where fiscal and monetary policies expanded dramatically in response to the covid pandemic. We saw gold in USD rise 24% in the year, but silver outperformed, rising 47.5% for the year in USD terms.

The average volatility of silver is almost double that of gold, with silver trading in a range of circa 31% in a given year, whereas gold’s annual volatility averages 15.8%. Higher volatility can also mean more opportunities for short-term focused investors with a higher appetite for risk.

3. Lower above ground stockpiles

3. Lower above ground stockpiles

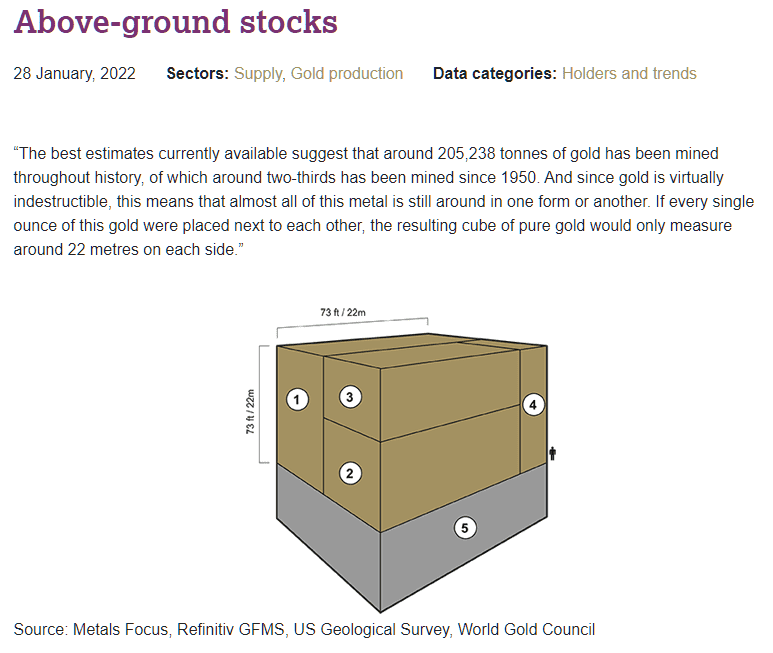

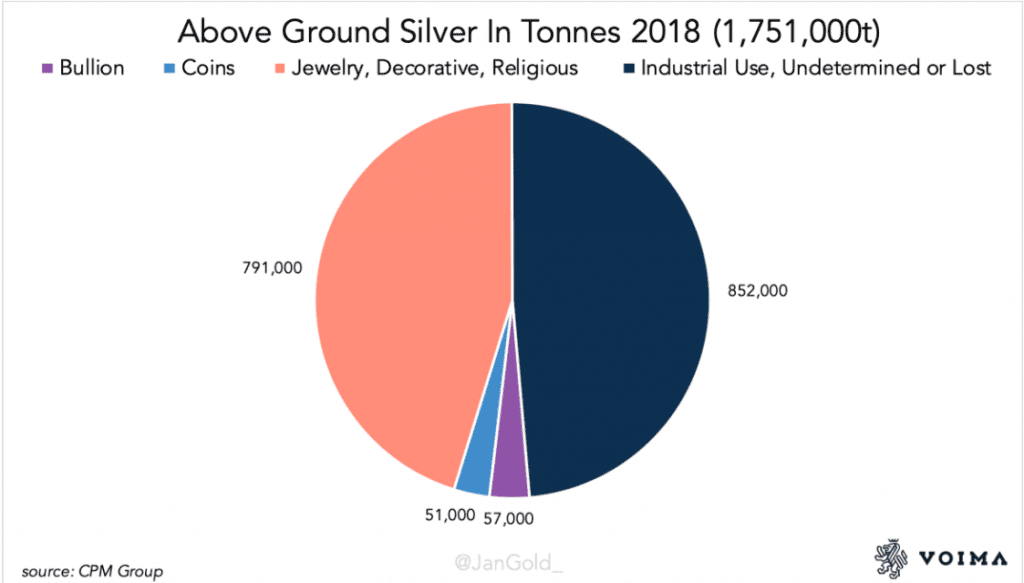

Today, the above ground stockpiles of gold are estimated to be around 200,000 tonnes. Most of the gold ever mined is simply recycled and not actually used up in industry. Silver on the other hand has around 2,000,000 tonnes of above ground metal, however in dollar terms this is vastly smaller. At today’s prices the 200,000 tonnes of gold stockpiles equate to $11.9 Trillion US dollars, whereas above ground silver sits at circa $1.4 Trillion US dollars in value. Surprisingly, only a small percentage of that is in investment grade bullion, with roughly 40% in industrial use and 40% in jewellery or decorative ornaments etc.

Given the lack of above ground stockpiles, it is quite common under certain months of excessive silver demand, that you find physical bullion very hard to come by, with stretched out waiting periods from refineries. If silver industrial demand was to grow rapidly in the coming years, we could easily see the market in a supply deficit, which could potentially be a great tailwind for a higher silver price.

4. Superior Industrial Applications

Of our two favorite precious metals, silver has by far the greatest number of industrial applications. From medical applications, to chemical-producing catalysts, to solar panels; silver has unique properties that cannot be replicated by other metals, which gives it the industrial demand that gold simply does not have. Some of the most notable uses in industry are:

- Photovoltaic solar panels

- Electronic devices and switches

- Circuit boards

- RFID tags

- Chemical catalysts

- Photography

- Medicine/ medical devices

- Brazing and soldering

- Bearings

- Automotive/electric vehicles

Almost every computer, mobile phone, automobile and appliance contains silver. Many of the applications such as solar PV and electric vehicles are growing industries that will require more silver raw material in future years.

5. Future EV Market Demand

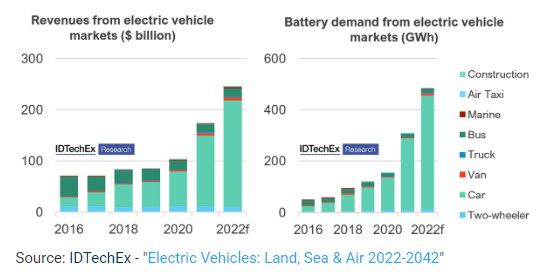

There is one new emerging market for silver industrial demand that could have a significant impact and that is the electric vehicle (EV) market. Right now, the electric vehicle market is still quite small, but it is set for dramatic growth in coming years. The trend is for most cars and large vehicles to move to a fully electric model in the near future and this will largely benefit silver demand, but not so much gold.

Almost every component in an EV requires some amount of silver, and demand from the EV sector is estimated to grow to over 90 million ounces of silver each year by 2025. This is almost 10% of the total silver market demand in a given year. Given there is currently a very tight supply of new silver coming from mines at the current price, the EV market could be enough to send silver into a consistent supply deficit over several years.

As we move towards a future focused on sustainability of the planet, silver will arguably play a much more important role than gold. A future which has electrical efficiency and net-zero emissions as major goal will likely require much more physical silver than today’s current environment.

To receive the latest gold and silver news, subscribe to our market updates by creating a free Guardian Gold Account here.

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

2. Increased volatility

2. Increased volatility 3. Lower above ground stockpiles

3. Lower above ground stockpiles