A warm welcome back from holidays from the team at Guardian Vaults to all of our valued clients! We have already seen some big moves in financial markets to start the new year, as the Federal Reserve turns as hawkish as ever. Tech stocks took a big hit overnight in the US with Cathie Woods Ark Invest ETF dropping -7% in a day. Interesting to see gold shrug off the latest FOMC minutes which talked of US Quantitative Easing ending as early as March this year. It’s one thing to stop new purchases of treasuries and other assets, but it’s another to try to unwind the $12 Trillion dollar balance sheet the Fed is now sitting on.

“Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate,” the minutes said.

The minutes suggest “fast and furious normalisation” compared with the last round of balance-sheet runoff, said Omair Sharif, founder and president of Inflation Insights. (Via Bloomberg)

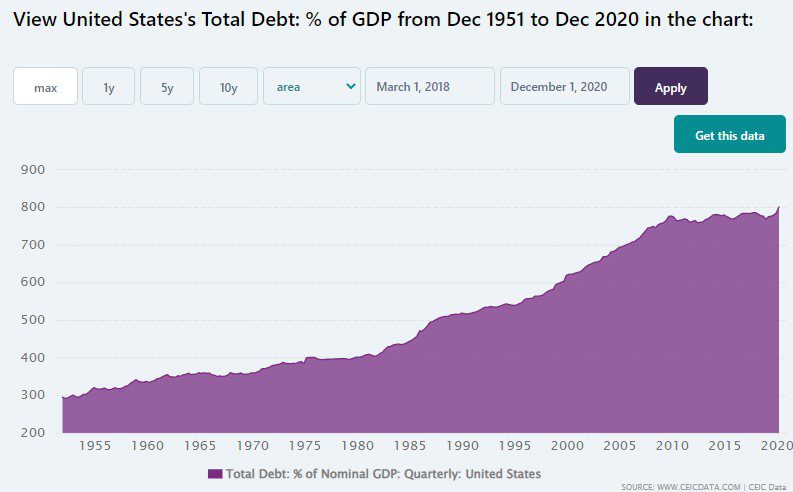

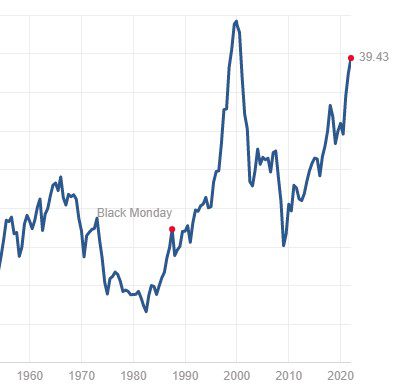

Well good luck with that, as we all know quite well how the last attempts to tighten monetary policy in the US went down. This time, debt levels across the board are at the highest levels in history, with US total debt over 800% of GDP. You also have equities trading at one of the most expensive P/E ratios in history, only surpassed by the dotcom bubble of 1999-2000. If ever there was a time where markets were exposed to potential shocks it would be 2022, so buckle up for what could be a very interesting year indeed.

S&P500 Shiller P/E Ratio

Precious metals have one major tailwind in 2022, and that is inflation. Inflationary environments usually coincide with the best performing years for precious metals as investors rush to safe havens and hard assets (just look at the 1970’s). High inflation also keeps ‘real’ bond yields low or negative, which makes gold look like a better alternative, so you might see funds flow out of bonds and into gold should inflation remain persistently high.

To start the year, gold and silver haven’t really woken up just yet, but keep a very close eye on the USD $1,850 level as we move into the new year. If gold manages to push above this point it would confirm the end of the recent downtrend from the 2020 highs above $2,050 USD. We will likely see gold get some attention from the momentum and trend chasing traders if we can manage to break above this level in the coming weeks or months. A break north of $1,850 USD should be the signal that the next leg in the current bull market is under way and would dramatically improve the technical picture for any investors that follow and trade off the back of charts.

Silver remains our pick from a long-term perspective, as the ratio remains well and truly elevated above historical norms (circa 80:1) and we have some really strong industrial demand tailwinds still to come. The Silver Institute expects silver demand from the EV sector to gradually build towards 90 million ounces per annum, which would make up circa 10% of the total global silver demand each year. Solar PV development projects will also continue to expand as many countries move towards greener energy production in order to meet net co2 emissions targets. From a technical perspective we would like to see silver hold above the $21.40 level this year. As the chart below indicates, this floor has acted as significant support in recent times. In 2022 we should see the silver price play some catch up to gold, especially if gold can break north of that $1,850 level in coming months.

To equities now and the US stock market is no-doubt in bubble territory as we start the new year. The most popular stocks with nearly no earnings but big promises of the future are the ones who have lately been seeing the most inflows. The ARKK ‘innovation’ ETF is the classic example of a stock picker chasing the most innovative sounding companies, whilst largely ignoring traditional measures of valuation. Rate hikes negatively impact companies with no earnings more so than ones with safe balance sheets, so it makes sense to see money finally bailing out of the ARKK ETF’s. Currently -44% from the recent all time high.

The ever-popular ARKK Innovation ETF

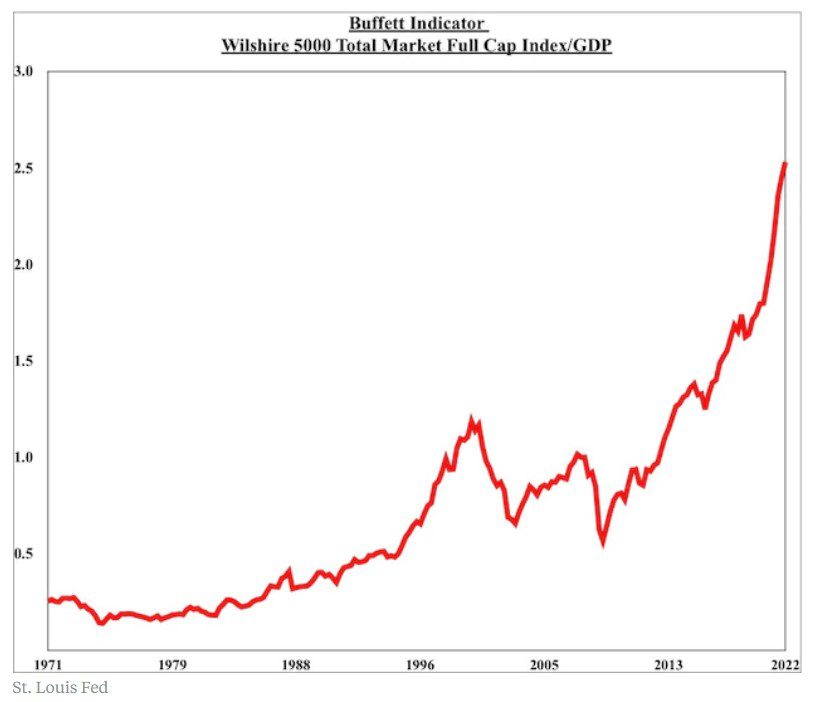

Warren Buffets famous stock market valuation indicator is in uncharted territory, signaling the most overvalued stock market in history. The Wilshire 5000 Total Market Index hit a new high or $48.99 Trillion this week, as it climbs to 211% of GDP. Buffet famously said that investors who buy stocks when this metric approached 200% were ‘playing with fire’. Add in the fact that the Fed intends on ending QE and raising interest rates at the same time, and we have a potential recipe for a major disaster in equities this year.

There are quite a few black swan potentials for the year to keep an eye out for. China/Taiwan tensions could escalate further (we should all hope not). The Russia/Ukraine invasion story is still ongoing. Evergrande and other Chinese property developers are struggling to prove their solvency, all whilst we have an unpredictable virus which we hope won’t mutate to a more deadly variant. It all adds up to a potentially explosive year ahead for financial markets, but let’s hope it is a great and prosperous one for the very patient precious metals investors among us.

Until next time,

John Feeney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.