With the financial year coming to a close, we take a look back at the last twelve month’s performance across various asset classes and see how precious metals markets stacked up. The past year was saturated with headlines around artificial intelligence (A.I). The investment theme took hold across US equity markets, with Nvidia dominating the performance of large cap stocks, temporarily rising to the highest valuation of any US company.

But is the A.I hype-train something akin to the Dotcom bubble? Or will companies truly take earnings to new levels with further adoption? We will take a look at some opinions in this report, cover the latest developments across the geopolitical spectrum, and discuss how precious metals as an asset class might be influenced moving forward into FY25.

Precious Metals Performance FY24

We start with a quick look back at precious metals performance, starting with the best performer of the year: silver. The AUD silver price rose 28%, supported by a combination of strong global industrial demand, Chinese investment demand, and record Indian imports. Industrial demand was helped along by strong solar PV demand, as many countries make the transition into greener energy sources. This trend is not expected to abate any time soon, with China leading the solar PV production industry, and continuing to invest in the sector. The silver institute expect solar PV silver demand to increase 20% in calendar year 2024 and the total overall silver market to have a demand surplus of 215 million ounces.

The silver market has experienced a demand surplus since 2021, with supply remaining stagnant and demand increasing by around 10% in total, we see prices naturally trading higher in response.

Silver FY24 Performance

| Silver Price (AUD) | 01/07/23 | $34.15 |

| Silver Price (AUD) | 30/06/24 | $43.67 |

| FY24 Performance | 28% |

This year saw western silver investment demand in the form of both ETF’s and physical bullion dropping lower since 2023. But eastern investment and industrial demand increases more than making up for this. India remains the world’s largest silver consumer and the Chinese property market issues boosted Chinese investment demand for both gold and silver this year.

Gold FY24 Performance

| Gold Price (AUD) | 01/07/23 | $2,877 |

| Gold Price (AUD) | 30/06/24 | $3,486 |

| FY24 Performance | 21% |

Gold benefited largely from Chinese investment and central bank demand this year. Central bank net demand totalled 290 tonnes in the March 2024 quarter, the strongest start to any year on record. Inflation concerns and geopolitical uncertainty also underpinned the market this year, with gold posting a strong return of 21% in AUD terms.

Comparative Asset Class Performance FY24

| Silver (AUD) | 28% |

| Gold (AUD) | 21% |

| Platinum (AUD) | 9% |

| AUS Gold Miners (XGD) | 11% |

| US Shares* | 24% |

| AUS Shares** | 12% |

| Balanced Superannuation Fund*** | 8.5% |

(*S&P500 Index Performance **ASX200 Index Performance ***AustralianSuper – Balanced Return)

Despite an A.I fuelled tech rally in US equities, silver in AUD terms outperformed the broader US stock market (S&P500 index) by around 4%, and gold in AUD almost on par, some 3% under US share market performance.

Notwithstanding much higher AUD gold prices this year, we saw Australian based gold mining equities underperforming the yellow metal itself. The XGD gold miners index proved that owning stock in gold mining companies doesn’t always translate into leveraged gains on the gold price. Gold mining equities saw constricted growth this past year, posting an 11% return, as the cost per ounce of gold produced rose with higher fuel, labour and other inflationary pressures. This combining with the fact that every ounce gets harder to extract each year, saw an underperformance relative to gold. Given the much higher risk profile of gold mining shares VS ordinary gold bullion, investors would usually expect to be repaid in higher returns than the gold price. So, the risk adjusted return for gold mining companies potentially disappoints a lot of investors this year, given gold itself is such an easy alternative.

Australian shares lagged US counterparts this year, as the ASX200 is heavily weighted towards financials and minerals; neither of which tend to benefit from a rising interest rate environment. The ASX is also quite lacking in the IT sector, with the major US tech companies contributing the vast majority of gains seen in the broader US stock market indexes this FY.

Australian Superannuation funds are set to post strong returns for the FY, with many performing over the 9% mark in balanced options. The nation’s largest superannuation fund, AustralianSuper has posted an 8.5% return in their balanced option, with bond markets underperforming and hindering the otherwise outstanding returns from US equities. Despite having the tailwind of the A.I fuelled run up in equities, boring old gold is set to outperform all balanced super options for the year with a 21% gain.

Guardian Gold Australia – Domestic Demand

In terms of Australian physical demand trends, Guardian Gold investors tilted allocations more towards gold than silver, despite the Gold:Silver ratio remaining very high for the first half of the year. Gold sales made up 67% of demand with silver demand coming in at 32% of volume. The vast majority of bullion demand was concentrated in gold and silver bar form, which represents the lowest buying premiums. Also, it’s good to see the highest demand in the top performing metals, with only 1% going into platinum this FY, which had weaker returns.

Guardian Gold FY24 Demand Mix

| Gold Bars | 59% |

| Silver Bars | 29% |

| Gold Coins | 8% |

| Silver Coins | 3% |

| Platinum | 1% |

Overall interest in bullion and the growth of the Guardian Gold brand was seen to continue during the financial year, with the number of bullion customers growing by 26% and transactions up by 19% VS FY23. The higher prices also saw some local investors cashing in on the market, with our buyback volumes increasing 55% on last year. Despite the rise in buyback volumes, the net-demand was heavily tilted towards those on the buy side throughout the financial year, with notably a record-breaking month for buying activity in April 2024.

A.I Stock Market Euphoria

The dominant investment theme of the past year was the boom in A.I related tech companies on the US stock exchange. There is usually a saying that the best performing market sector one year can often be the worst performer the following year, but market participants are somewhat split on whether A.I enthusiasm has already overshot the rational level.

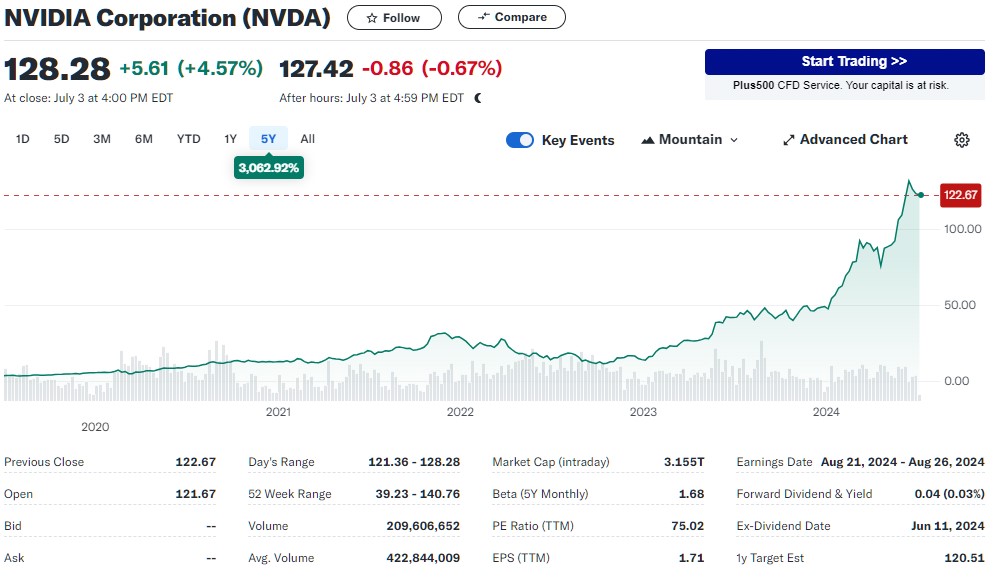

No doubt the first initial rush towards A.I hardware and high-powered chips has seen a huge boost to the market leader Nvidia’s revenue and earnings. The company quicky transitioned from a gaming GPU designer and manufacturer, to a market leader in chips that will power A.I models in future years. The outperformance of both revenue and earnings VS expectations sent the stock valuation over $3.1 Trillion USD ($4.6 Trillion AUD). To put this into perspective, the total Australian superannuation assets sit at $3.5 Trillion AUD, so the single company is valued at 1.3x the total of Australian superannuation assets, and around 44% of the entire Australian residential property market.

Nvidia now has a trailing price to earnings ratio of 75x, and the other market darlings in tech are well above broader market historical averages. This should come of a concern for valuations being somewhat stretched, as these high PE companies need to witness a dramatic rise in earnings from this point onward to maintain current valuations.

Billions are being invested into A.I infrastructure, with many companies banking on discovering ways to capitalize on this huge investment. If we don’t see the investment translate into higher revenue or earnings, then the tech sector in the US is potentially exposed to a significant correction.

This thought process is probably behind the recent reports of US hedge funds selling down the tech sector at a fast pace, with JP Morgan noting the tech sector is currently being “propped up” by strong retail and exchange traded fund buying, which is acting as a counter-weight to hedge fund exits.

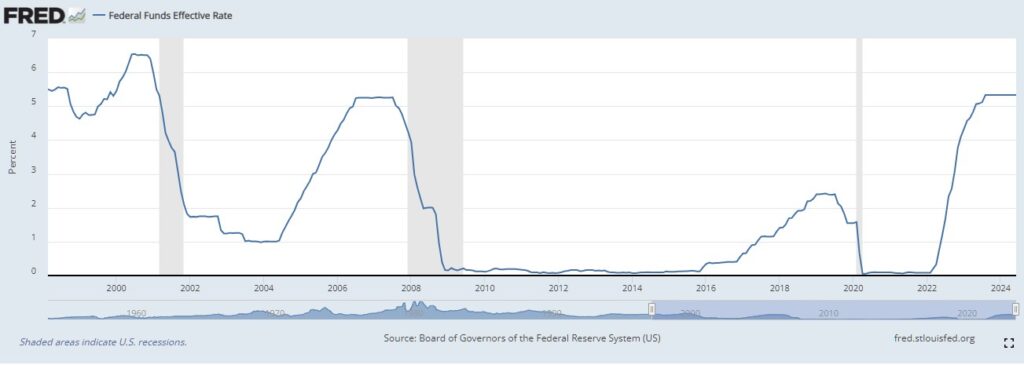

Apart from valuations being historically high, the other concern for US markets is the risk of recession, as a result of the rapid rise in interest rates. We can see in the Fed funds rate chart below, the grey highlighted areas are when recessions hit the US, and every time they followed closely behind a rate hike cycle. With the severity of this last interest rate hike cycle, many should ask the question: “is this time different?” Will A.I save the US from recession?

BCA Research chief global strategist thinks not. With Peter Berezin revising his year-end target for the S&P500 to 3,750, due to expectations that the US will soon enter a sudden and unexpected recession late in late 2024 / early 2025. One of the many risks A.I presents, is increasing theft, fraud or hacking of digitized financial assets. The sophistication and sheer number of online cyber-crimes is likely to go through the roof in coming years. This, we would hope, would really emphasize the importance of non-digital financial assets such as physical gold, as a store of wealth that sits safely outside the digital environment.

Geopolitical Tensions

On the geopolitical front, there was not much in the way of improvement during the financial year. The war in Ukraine seems to be in a stalemate with Russia slowly gaining ground and coming closer to capturing the entire Donetsk region. Further escalations in the Middle East added a bid to the gold price this FY, with the war in Gaza seeing involvement from Iran and more recently Hezbollah in Lebanon. The Albanese government is drawing up plans to evacuate up to 20,000 Lebanese-Australians from Lebanon should war break out between Israel and the Iranian-backed militia Hezbollah. Then we have the tensions in South China Sea, and Xi Jinping claiming Taiwan is ‘destined for reunification’.

The geopolitical environment is the worst it’s been in years and any hope of simmering tensions seems farfetched at present. If a Taiwan invasion is in fact a real possibility in coming years, financial markets are currently pricing in a 0% chance of this happening, so you would expect very significantly share market volatility if this were to take place. Share markets have a tendency to misprice negative risks though, so it is no surprise that markets are shrugging off the potential of another global war.

Gold & Silver FY 25 Outlook

The gold market in FY25 will likely be focused on inflation numbers, and whether or not the US can avoid a recession after such a sharp rate hike cycle. For the silver market, demand will be underpinned by industrial sources, with the question on whether or not investment demand will remain strong at these higher prices.

On to major bank gold forecasts, Citi Bank’s head of commodities research in North America, Aakash Doshi. Doshi notes a “likely wildcard path to $3,000/oz gold is a rapid acceleration of an existing but slow-moving trend: de-dollarization across Emerging Markets central banks, that in turn leads to a crisis of confidence in the U.S dollar.” He also notes the possibility of a “deeper global recession” that could spur the US Federal Reserve to cut rates rapidly in response.

A recent article in The Australian covered Citi Bank’s new investment thesis for gold, noting ‘at the core of the framework is the notion that investment demand – from both private and public sector – taken as a share of gold mine supply is the primary driver of gold pricing’. Chinese investment and central bank demand combined have risen to 85% of mine supply during the first quarter of 2024, up from a 25% average in 2019 to 2022. ‘Looking ahead, we expect gold investment demand to rise to absorb almost all mine supply over the next 12-18 months, underpinning our base case for $US2700- $US3000 per ounce gold during 2025.’

Commodity analysts at ANZ have noted they expect gold to trade near $US2,500 and silver above $US31.00 by the end of 2024, noting ‘an upturn in the electronic cycle and potential demand growth from the solar sector bodes well for silver’s industrial consumption.’

Of course, forecasts should never be solely relied upon as investment advice, but it’s encouraging to see major investment banks realising the importance of a gold holding in a well-diversified investment portfolio. The major question above both metals this past financial year was whether or not they could continue to be a true inflation hedge. That question has been answered once more, with very strong returns, despite a much higher interest rate environment.

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Current gold prices:

Subscribe to our free market reports by creating a Guardian Gold Account Here.

Next Blog:

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Follow Us On Socials